When it comes to credentials vaults that aggregate payment information and store credentials securely, and updating payment information shared with merchants when consumers change payment methods or account numbers, whom consumers trust is a changeable matter.

In collaboration with FIS, PYMNTS analyzed this in the study “Payments and Credentials Vaults: The Trust Factor,” collaboration, and found that interest in using credential vaults is rising across the digital commerce spectrum as younger digital-first demographics trust these services more.

Per the study, “While 38% of consumers overall say they are highly interested in using a credentials vault, 61% of consumers who experienced issues with their payment credentials — such as losing a card or getting a new one — and who had stored 10 or more credentials are highly interested in vault use. Additionally, consumers are at least 17% more likely to say they are interested in using a credentials vault if they have faced these challenges than those who have not yet experienced any issues.”

Trust goes to the heart of it, as half of consumers would allow marketplaces to access their information using vaults. Consumers evincing interest in vaults are willing to grant most merchants access to their information; this willingness generally increases alongside a consumer’s interest in using a credentials vault. Per the data, 69% of highly interested consumers would allow marketplaces to access their information through a vault, but only 27% of consumers with a slight interest in vault use say the same.

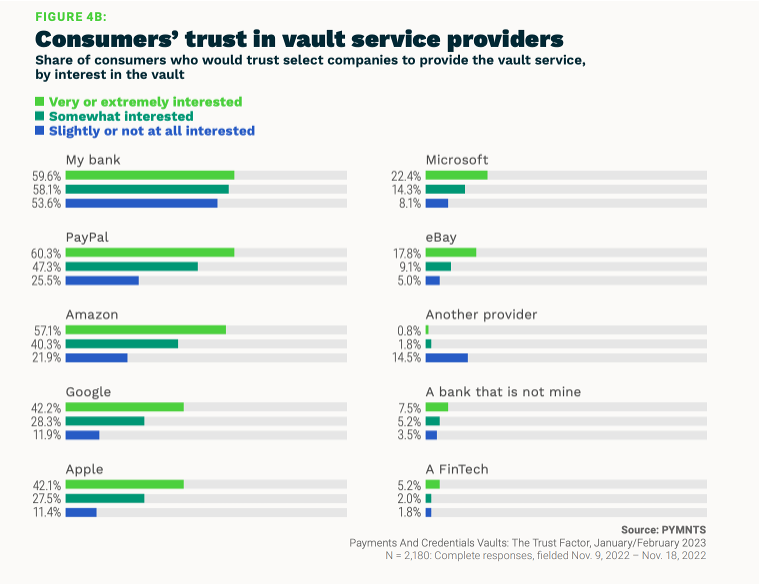

Not surprisingly, interested consumers tend to trust entities that are not financial institutions to provide this service more than those less interested. For instance, 60% of consumers who are very interested in using the vault would trust PayPal to provide this service and 57% would trust Amazon. Consumers who say they are only slightly interested or completely uninterested in vaults have contrasting views, as only 26% would trust PayPal and 22% would trust Amazon to provide vault services.

However, as the study states, “Primary banks are still the organizations they would trust most to provide vault services: 57% of consumers say they would trust these institutions to provide this service. Comparatively, 44% of consumers overall say they would trust PayPal to provide vault services; 40% say they would trust Amazon.”

____________

Online Marketplaces or Banks? Consumers Torn on Trusted Keeper of Secure Payments Credentials

Consumer interest in using digital payments credentials vaults depends on who they trust with the keys, with more than half seeking vault options from their preferred online marketplaces or personal banks, according to “Payments and Credentials Vaults: The Trust Factor,” a collaboration with FIS, a new study of 2,180 consumers asked who they’d trust to keep stored payment credentials secure.

Get your copy: Payments and Credentials Vaults: The Trust Factor

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: