Stripe conducted a detailed review of the top 450 e-commerce websites across the UK, France, Germany, the Netherlands, Spain, Italy, and Sweden and found that 58% of checkouts had at least three basic errors, adding unnecessary friction for customers and complicating the checkout process.

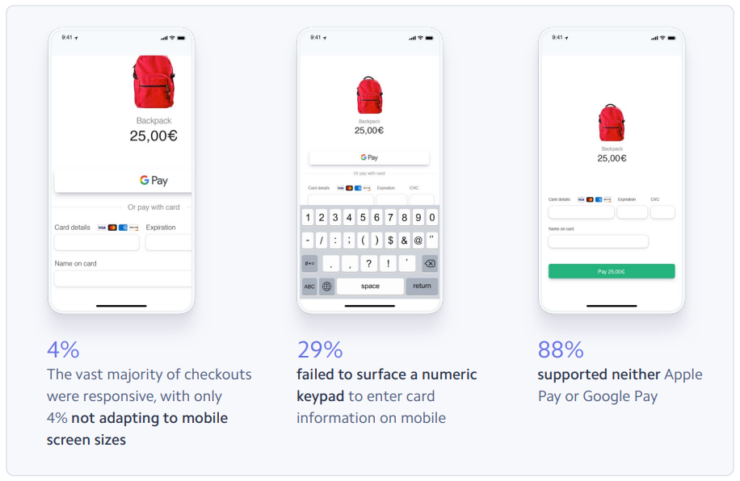

Some of the most common issues include not automatically verifying the card number as it was entered, the absence of a numerical keypad for entering card numbers on mobile devices, and allowing transactions to be submitted with incorrect card numbers or expiry dates.

“This adds unnecessary friction for customers and complicates the checkout process”, the company explains in its study [pdf].

The checkout page is the most important page on every ecommerce website. It’s the place where the deal officially takes place. It’s the place where visitors turn into buyers. So, it’s very important to offer a frictionless experience on the checkout page.

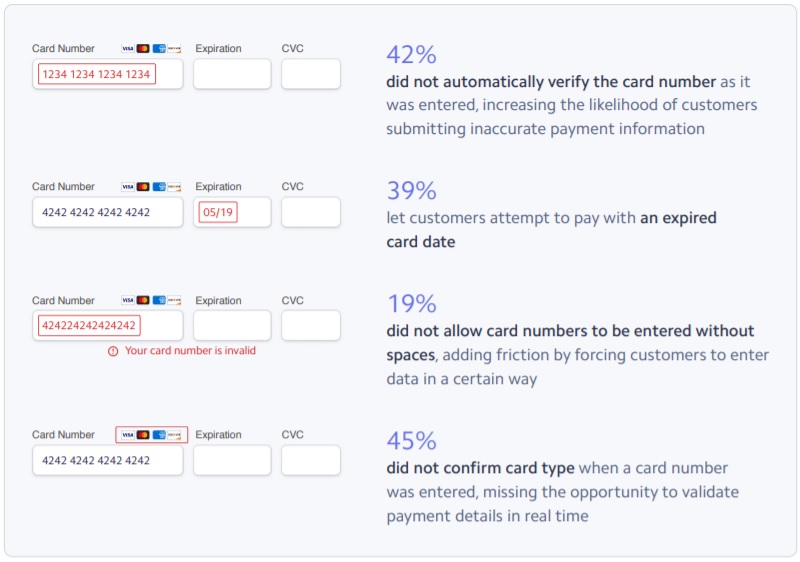

These are some of the most common errors found at checkout pages:

. [42%] Not automatically verifying the card number as it was entered

. [29%] The absence of a numerical keypad for entering card numbers on mobile devices

. [39%] Allowing transactions to be submitted with incorrect card numbers or expiry dates.

“On their own, these issues may seem small. But, when combined, they add up to a needlessly difficult checkout experience for customers. With nine out of ten lost sales in Europe failing on the checkout page, fixing these basic errors and reducing friction in the transaction process can result in significant increases in conversion and revenue.”, Stripe comments.

More than one-third of e-commerce companies added unnecessary friction to their checkout flow, preventing customers from checking out.

The number of checkouts that did not enable card numbers to be entered without spaces differed the most. According to the company, checkouts in Italy and the Netherlands performed the worst for many of the factors it assessed.

For example, in Italy two-thirds of the analyzed websites didn’t confirm the card type when a card number was entered. Furthermore, 56 percent didn’t automatically verify the card number. And in the Netherlands, half of the checkout pages didn’t confirm the card type, while 56 percent let customers attempt to pay with an expired card date.

Entering card numbers with or without spaces

But with regards to checkouts allowing the card number to be entered without spaces, the Netherlands performed the best. Checkouts in France performed the worst, with about four in ten not accepting numbers without spaces. “Customers should be able to enter card numbers how they want (with or without spaces) and not encounter any errors”, Stripe thinks.

“Although it is recommended, however, to allow card numbers to be entered with spaces, or visually separated into groupings of four digits, for easier data validation.”

Only 12% support mobile wallets

Another interesting finding is that although 96 percent of checkouts adapted to mobile screen sizes, only 12 percent of these pages supported mobile wallets. Checkouts in Sweden were the most likely to optimise for mobile, with every single checkout we analysed being both responsive as well as surfacing a numeric keypad to make entering card details easier on mobile.

And there were more problems with mobile devices.

Checkouts in the UK performed the best in terms of digital wallet support, with 22% offering Apple Pay or Google Pay (the highest percentage among all analysed countries). German checkouts performed the worst, with only 4% of checkouts supporting digital wallets (likely because these wallets were introduced more recently in Germany).

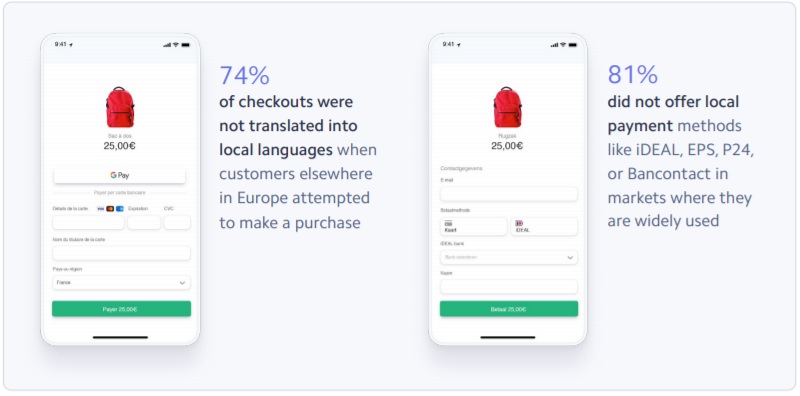

Another problem with many ecommerce checkouts is that they aren’t translated into local languages. Also, 81 percent of all European checkouts didn’t offer local payment methods like iDeal, EPS, P24 or Bancontact.

Regarding these two topics, there were again big differences across the countries. In Spain, none of the analyzed checkouts were translated into other languages or offered local payment methods for consumers elsewhere in Europe. But in the Netherlands, checkouts were most likely to be available in other languages. Here, local payment methods were also not very popular.

Methodology

In conducting the analysis in this report, Stripe selected the top 50 e-commerce websites in the UK, France, Italy, the Netherlands, and Spain, and the top 100 websites in Sweden and Germany, based on the Alexa ranking for the specific country. Adult entertainment platforms or online gambling websites were not included in the analysis.

After determining the relevant websites, each one was tested for pre-defined errors by placing a product in the shopping cart to simulate an online purchase and in some cases, using a VPN to complete the checkout process as customers based in different countries.

Checkouts were tested for a total of 11 errors related to checkout form design and mobile optimisation. Checkouts were also evaluated on additional optimisation opportunities, like whether they supported digital wallets and local payment methods in markets where they are widely used, and whether they were translated into local languages when customers elsewhere in Europe attempted to make a purchase.

Checkouts in the UK, France, Italy, Spain, and the Netherlands were tested for all errors and optimisation opportunities. Checkouts in Germany were tested for checkout form design, mobile optimisation, and whether they supported digital wallets. Checkouts in Sweden were tested for checkout form design and mobile optimisation.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: