. The growth of mCommerce is already driving biometric authentication

. Consumers think biometric authentication is more convenient, but are still unwilling to move away from passwords

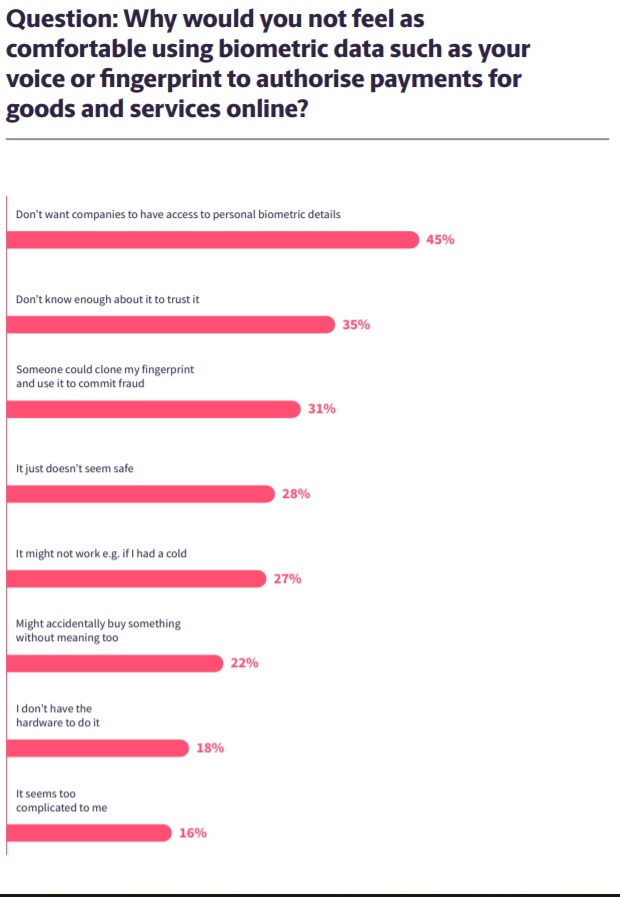

. Consumers have strong concerns about the security of their financial data, which is preventing adoption

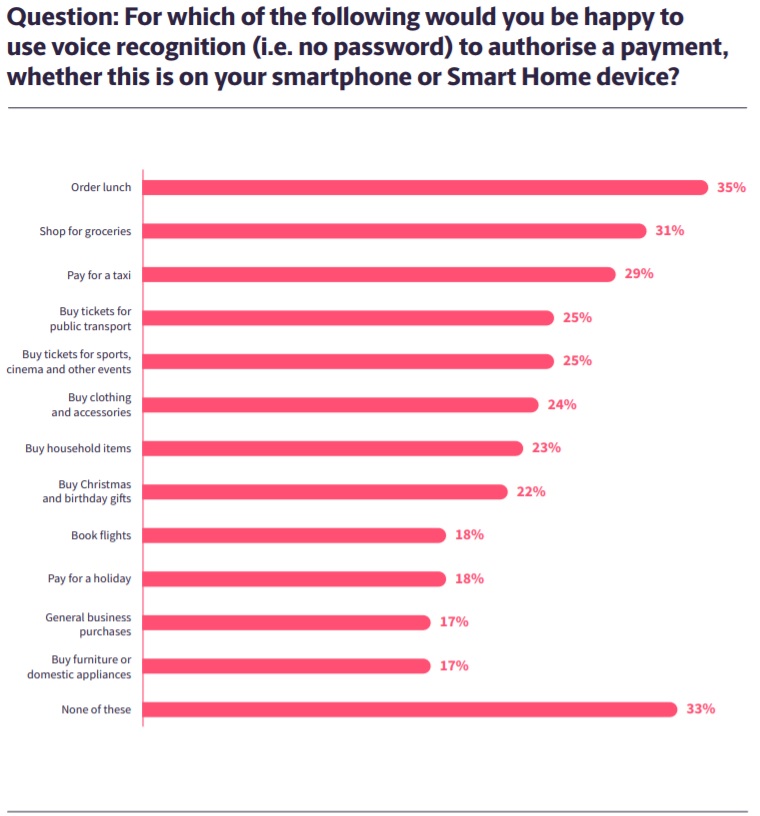

. Consumers are more comfortable re-ordering low value items and buying entertainment services than making high value or one-off purchases

. Generation Z is more willing to use voice-activated technology to make payments than any other age demographic

The evolution of the payments industry is driven by three key factors; technological innovation, regulation, and consumer appetite. In the case of biometric payment authentication replacing passwords, the technology and regulation is in place to usher in a new era for card not-present transactions.

61% of consumers believe that using biometrics is a much quicker and more efficient way of paying for goods or services than traditional online payment methods, and 57% of consumers agree that being able to verify their payments using biometric technology will make shopping on their smartphone more convenient than traditional desktop eCommerce, according to a research commissioned by Paysafe Group.

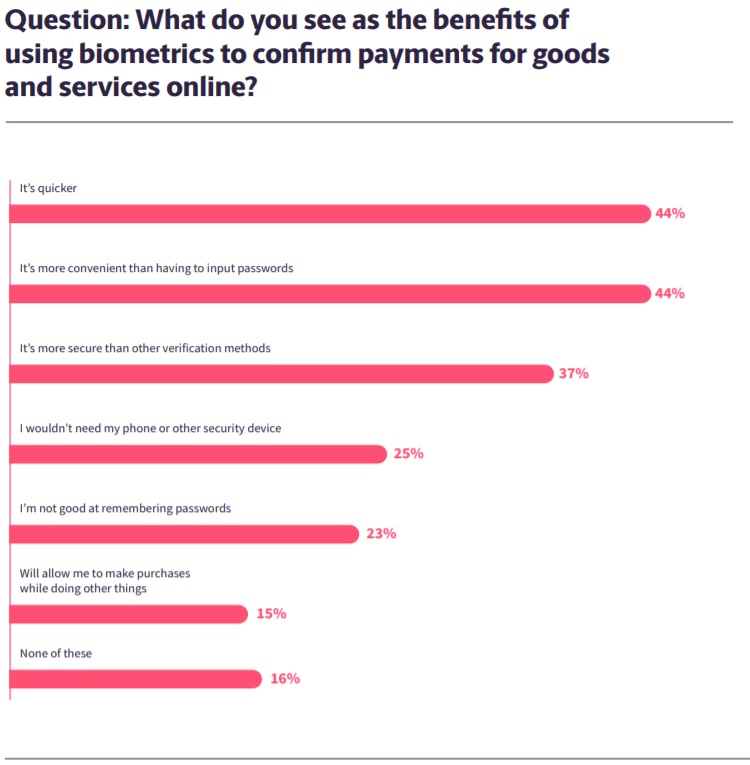

However, consumers are less aware of the security benefits of biometric authentication. Only 37% of consumers believe that biometrics are more secure than other verification methods and 66% of consumers said they would be worried if they were able to make purchases without being prompted for a password.

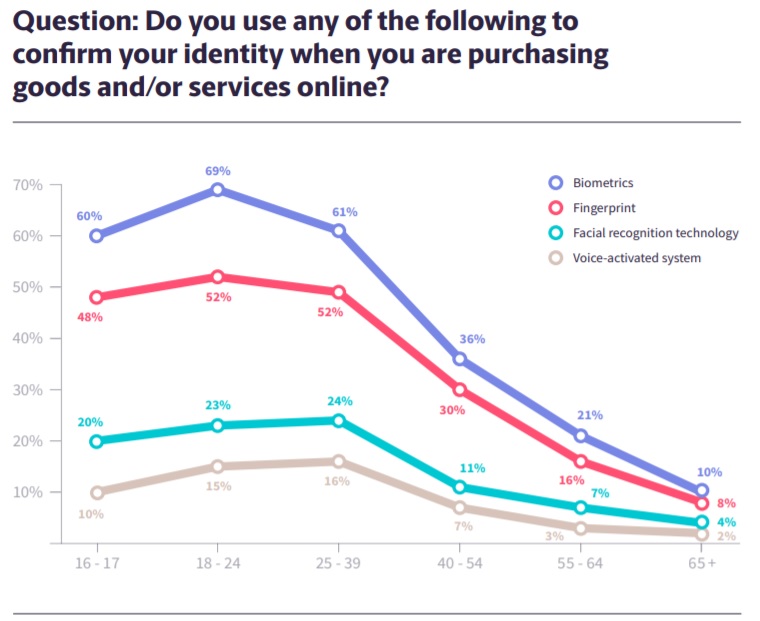

One interpretation of this data is that younger consumers are intrinsically more comfortable with the concept of sharing their biometric data and the validity of biometric authentication when making payments. However, what is more likely is that their stronger propensity to shop using their smart devices is exposing the benefits of biometric authentication to these groups.

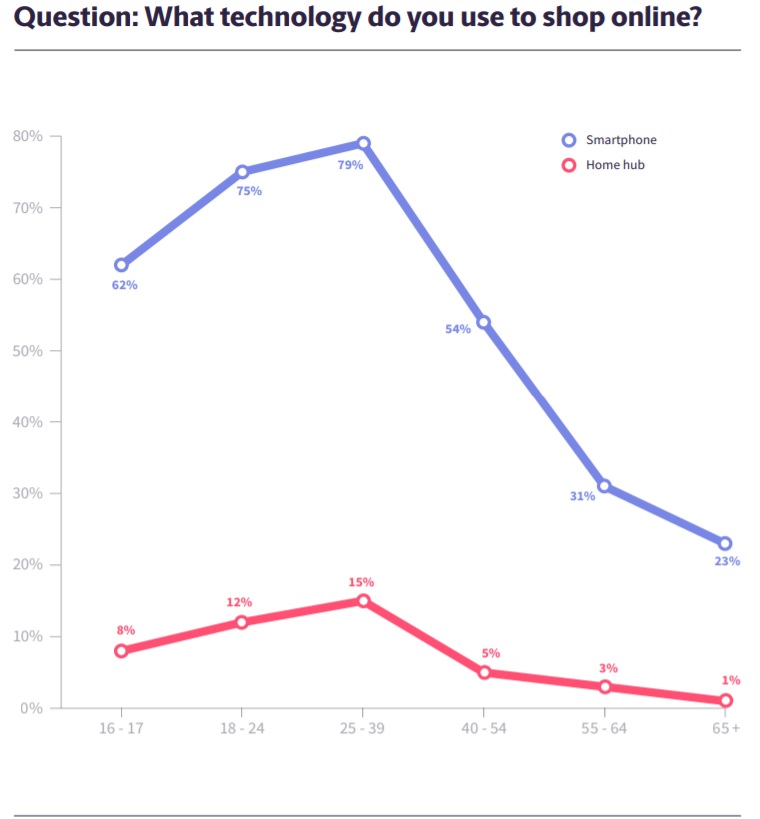

This hypothesis is borne out by the correlation between use of biometrics for payment authentication and the percentage of consumers that shop using their smartphone. Three quarters of 18-24-year-olds (75%) and a higher percentage of 25-39-year-olds (79%) shop online using their smartphone, followed by 62% of 16-17-year-olds. This figure falls to 54% of 40-54-year-olds, 31% of 55-64-year-olds, and 23% of over 65s.

In addition, when comparing different methods of biometric authentication, a consistent pattern emerges across every age group of consumers. Fingerprint technology is the most familiar method of biometric authentication (38%), followed by facial recognition technology (17%).

Adoption of voice-activated authentication (11%) is significantly lower than both fingerprint and facial recognition technology. This reflects the gap between the percentage of consumers that currently make online payments using a smartphone and the percentage that make payments on a Smart Home device.

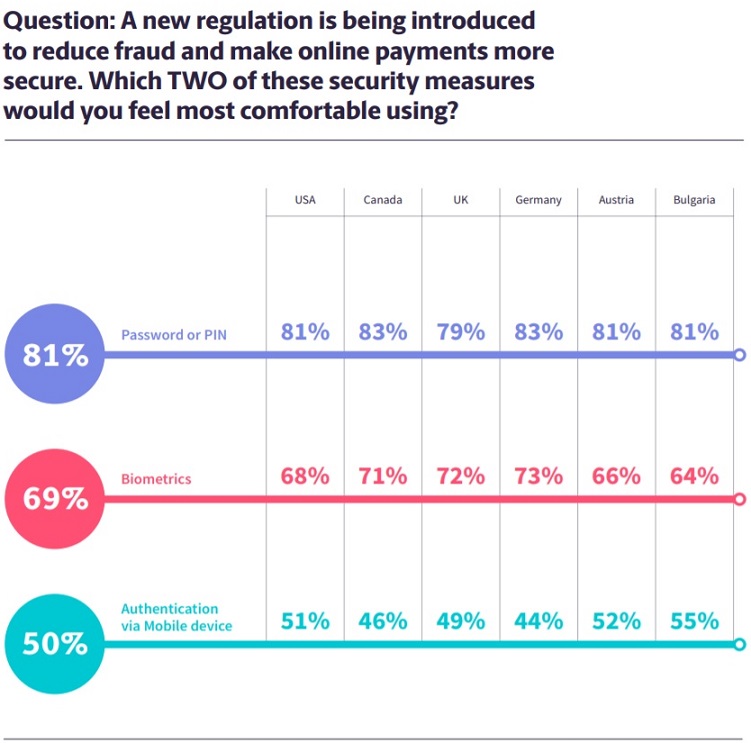

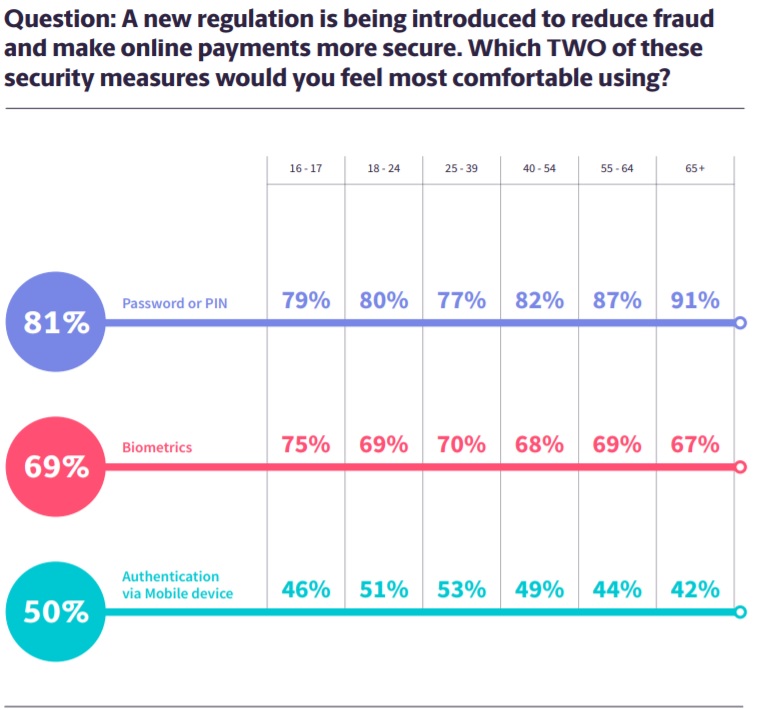

The introduction of a two-of-three factor authentication process is intended to limit the need for passwords and promote more frictionless verification methods. However, our data suggests that establishing enough consumer trust to move away from a password-centric authentication will be a drawn-out process for payment services providers and online businesses. Passwords will remain the security preference of consumers in the short-tomedium term; biometrics will only serve as a supplementary layer to consumers’ payments security habits.

When consumers were asked which two authentication factors they would feel most comfortable using when making a payment, a password (what you know) was the overwhelmingly the most popular choice with consumers from every country surveyed. Over four out of every five consumers (81%) remain most convinced by entering a password or pin. 69% selected biometrics (what you are) as a preferred authentication method, and 50% said that they felt comfortable confirming a payment via a mobile device message (what you have).

This reluctance to move away from passwords isn’t because consumers don’t appreciate the convenience that biometrics brings to the checkout. 61% of consumers agreed that using biometrics is a much quicker and more efficient way of paying for goods or services, and 57% agreed that being able to verify a payment using biometric technology would make shopping on their smartphone more convenient than traditional desktop eCommerce. 65% agreed that automated payments would mean less time at the checkout which would make the shopping experience more enjoyable.

Adoption of biometric verification will accelerate as consumers become more familiar with the technology, but this research strongly suggests that consumers are not ready to put their trust in them entirely at this point.

Voice-activated technology: the future of eCommerce?

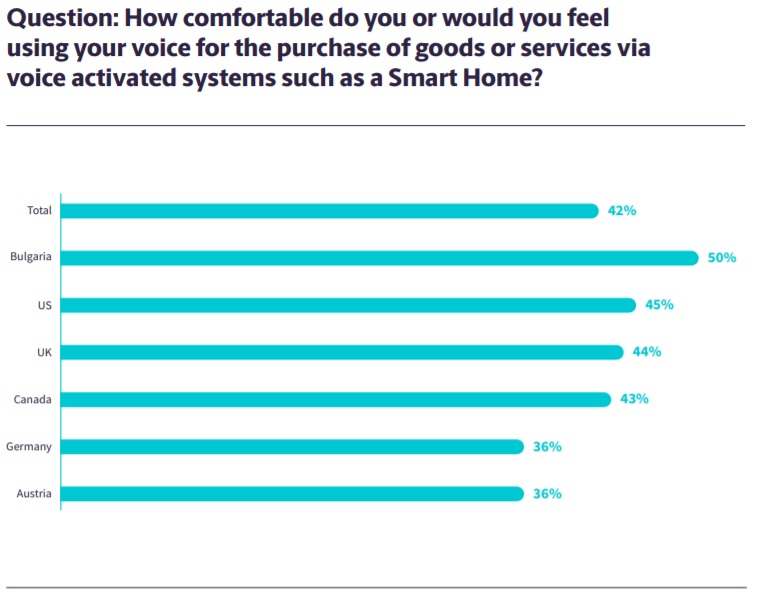

A second area where biometrics is beginning to influence online payments is voice-activated technology. 100 million users worldwide now have some form of voice-activated Smart Home technology such as Google Home or Amazon Alexa, meaning that consumers are adopting the hardware that will enable them to shop online, pay bills, and make person-to-person transactions using voice command alone.

Also now available in the market is Internet of Things (IoT) enabled technology such as smart televisions and fridges, which have the potential to push this trend even further. But with these technologies still new to consumers, and as password authentication is still very much the central pillar to financial data security for the majority of consumers, current appetite for these new methods of online commerce are debatable.

A distinction between ordering and shopping

A clear divide is present when it comes to making payments using voice-activated technology – consumers are in favour of repeated, low-value payments, but not high value, one-off purchases.

A pattern emerged when consumers were asked about which types of goods or services they would be comfortable paying for using a voice-activated payments system. Consumers are more content with ordering or re-ordering familiar goods or services, but less prepared to make one-off payments that require comparing goods or suppliers.

One reason for this could be that where a ‘shopping experience’ is required to select the appropriate items using a separate device or a mobile app or browser, the convenience benefit of making the purchase using voice-activated technology is lost.

Another reason may be that consumers feel more secure making voice-activated purchases from trusted suppliers that they shop with regularly, but less confident making single purchases from less familiar suppliers.

The payments ecosystem is trending towards more frictionless payments generally, for both online and in-person transactions, but this research provides further indication that consumers will not compromise the security of their financial data to do so. As new fintechs and technology giants from outside of the traditional banking and payments sector begin to enter this space, this is the critical factor to bear in mind. Adoption of innovative technology is dependent on winning the argument over financial safety.

This research was conducted by Loudhouse, a London based research agency, in April 2019. For this report Paysafe surveyed 6,000 consumers from the UK, Canada, the US, Germany, Austria, and Bulgaria to assess current consumer attitudes to biometric payment authentication as a replacement to the passwords that they are familiar with.

Download the full report here: Lost in Transaction: The end of risk?

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: