25.5% of ecommerce in Europe is cross-border. Only omnichannel retailers in top 10, for the first time.

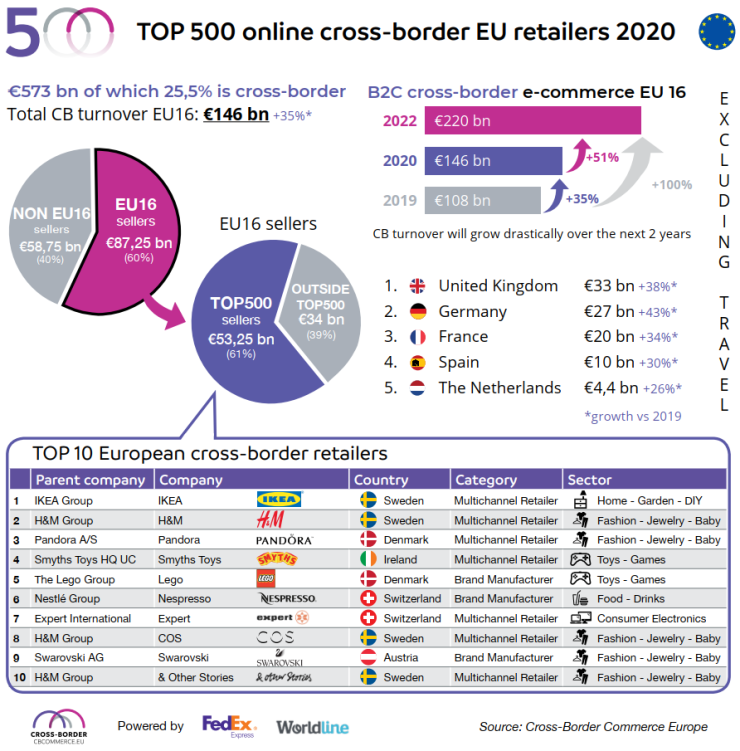

The online cross-border market in Europe was worth 146 billion euros in 2020. This is an increase of 35 percent compared to the situation one year before. The cross-border share is slowly increasing. In 2018 it was 22.8 percent, in 2019 it was 23.55 percent and now it’s growing towards 26 percent and more.

Cross-Border Commerce Europe, the platform that stimulates cross-border eCommerce in Europe, releases a major research paper covering and ranking the 500 strongest European players with a focus on cross-border performance. The total online EU cross-border market represents a turnover of €146 billion in 2020 (excluding travel), a record increase of 35% YTD.

In this third edition of the “TOP 500 Cross-Border Retail Europe”, Ikea maintains the leading position. The H&M group, with its 3 main brands in the TOP 10, paves the way to a robust cross-border strategy. A study produced by CBCommerce with the support of FedEx Express and Worldline.

For the first time, this TOP 10 is dedicated to omnichannel retailers only. New entrants are Swarovski, Pandora, Expert, Cos and “& Other Stories”. Leavers are pure player marketplaces Zalando and Vivino, as well as C&A, Zara and Tomtom.

B2C online turnover from goods exploded with 24% over 2020 up to €573 billion. In 2020 cross-border e-commerce revenues (excluding travel) reached €146 billion in Europe; a record increase of 35% compared to 2019. Cross-border online sales outperformed total online sales. The main reason for this special achievement is the corona virus impact.

The TOP 500 Cross-Border Retail Europe “made in Europe” generates €53,25 billion within the EU16 representing a market share of 61% of the total cross-border eCommerce market in Europe with an increase in sales of 34% compared to 2019.

Within the TOP 10 representing 22,2% of the TOP 500 sales, Ikea maintains its leading position and achieves a cross-border turnover of €5.1 billion, an increase of 11% compared to 2019.

The H&M group is taking the lion’s share with its 3 main brands: H&M, Cos and & Other Stories. The H&M e-shop has an average of 90% cross-border visitors, reaching nearly €4 billion cross-border turnover outside of Sweden in 2020.

H&M demonstrates with “& Other Stories” that an online cross-border expansion strategy successfully outperformed new stores openings. “& Other Stories” has 74 stores in 22 markets and online shops in 33 countries.

| # | Cross-border retailer |

| 1 | Ikea |

| 2 | H&M |

| 3 | Pandora |

| 4 | Smyths Toys |

| 5 | Lego |

| 6 | Nespresso |

| 7 | Expert |

| 8 | Cos |

| 9 | Swarovski |

| 10 | & Other Stories |

The Covid-19 impact

As non-essential stores closed during the lockdown, retailers massively turned to online, prioritizing expanding cross-border trade through online shops. On average, omnichannel retailers saw an increase of 45% (up to +70% in Q4 2020) in online trade.

Nevertheless, fashion as the largest product category (half of the TOP 500 are fashion online shops), lost 15% turnover (online and offline) over 2020. The huge increase of online could not compensate the long lockdown closure of the stores. Food Mass Merchants increased their total turnover (online and offline) by +10% compared to 2019.

67% of Europeans appreciate the convenience of cross-border eCommerce. Brexit and the spread of the Coronavirus, confirmed a bright future for cross-border e-commerce in Europe.

“I want to warmly thank our research team and partners FedEx Express and Worldline for their support in establishing this new ranking. It makes the best European players in cross-border eCommerce transparent and stimulates the entire retail industry” concludes Carine Moitier, founder of CBCommerce.eu.

___________

Cross-Border Commerce Europe is the European network and knowledge platform for all eCommerce and omnichannel players present in at least three countries in Europe. CBCommerce.eu connects the different actors with each other to increase visibility, share knowledge and figures, identify trends and specificities of each European country. Members of Cross-Border Commerce Europe are brands and retailers of all sizes. Partners are suppliers of services in all areas of trade.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: