Like just about everything else in the world, the way we pay for things is changing. And as the American Express Trendex Digital Payments survey* of U.S. businesses and consumers shows, those changes have been well received.

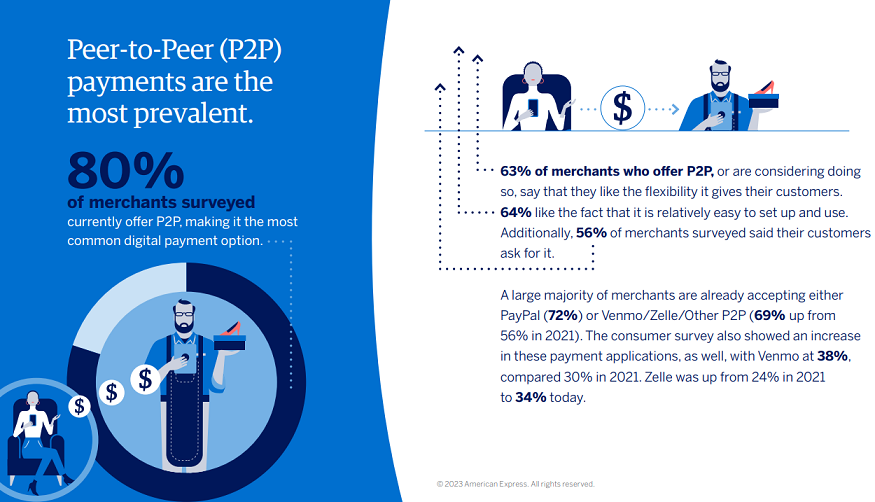

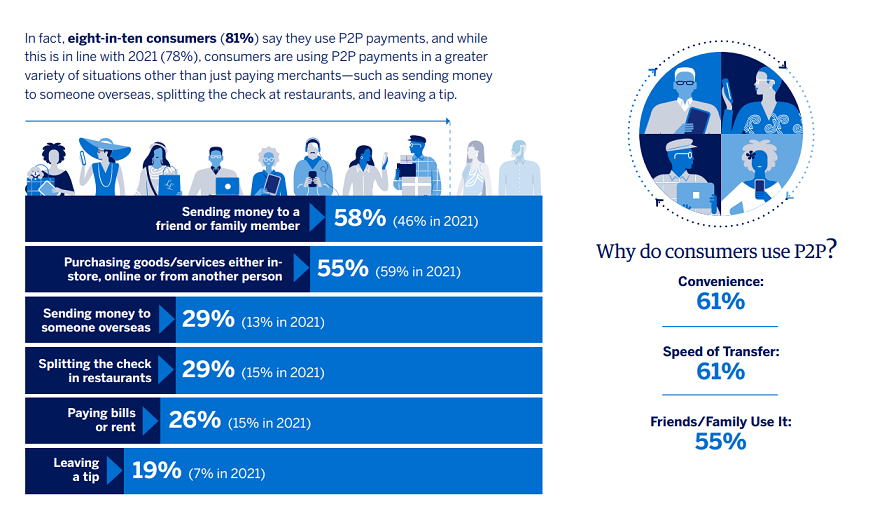

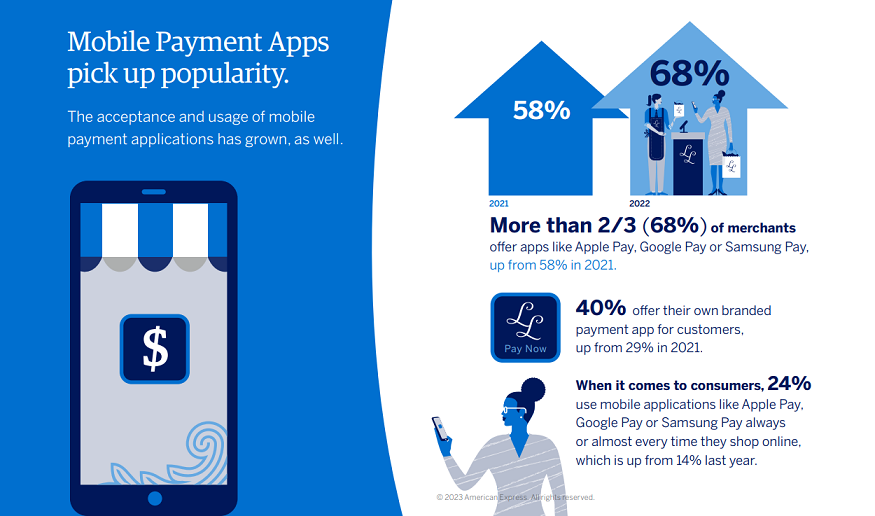

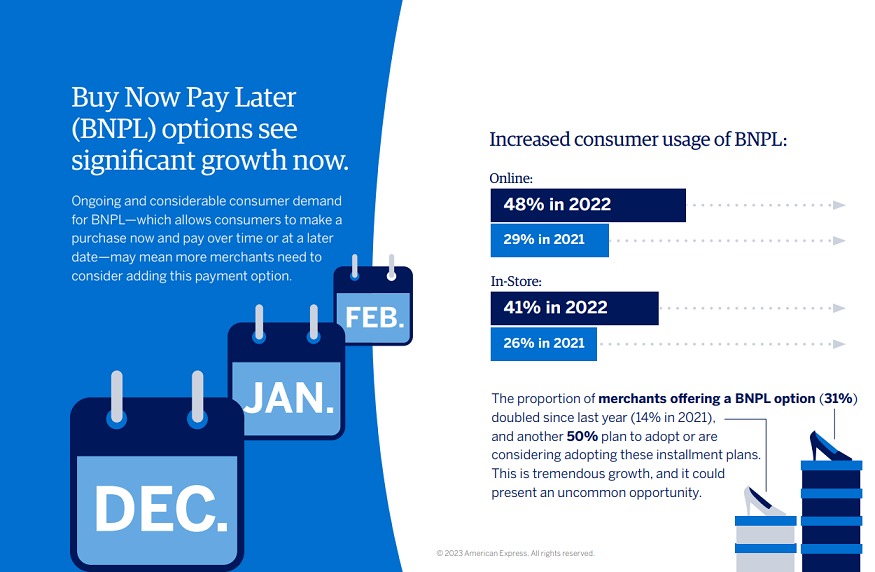

Compared to previous Amex Trendex Digital Payments surveys, merchants generally show a trend towards offering new and more varied digital payment options to address customer needs. Acceptance of P2P, mobile wallets/pays, store-branded payment apps, pay buttons, and social media payments are all on the rise.

Contactless cards and digital wallets are among the fastest growing digital payment options. According to the latest Amex Trendex: Digital Payments Edition Report1, 74% of U.S. consumers say they have used contactless cards and digital wallets – looking to use tap to pay at the grocery store (48%), retail shops (40%), restaurants and convenience stores (38%), as well as gas stations (37%). And as more countries implement contactless payment options, this category has more runway to grow.

Also, almost a quarter of consumers use mobile applications always or almost every time they shop online, according to Trendex.1

“Consumers expect payments to be seamless and secure, no matter how they choose to pay,” said Matthew Robinson, Executive Vice President and General Manager of Network and Acquiring Solutions at American Express. “Digital payment options are delivering a faster and even safer experience for both our Card Members and merchants.”

Lisa Yokoyama, Senior Vice President and Head of Product of Amex Digital Labs, added, “At American Express, we’re focused on continuing to expand payment options for Card Members by making them flexible and seamless. This includes products and services that make it easier to send money to friends, pay bills, and conduct online transactions. We focus on listening to what Card Members want and leveraging our technology and partnerships to help make it happen.”

____________

*Research Methodology

The Amex Trendex 2022 Digital Payments Edition is based on a sample of 1,011 respondents weighted to U.S. census based upon gender, age, education, race and region.

Unless otherwise noted, responses among consumers represent U.S. adults 18+ who have made an online purchase three or more times in the 12 months prior to the survey, based on self-report. The anonymous survey was conducted using an online panel, with fieldwork conducted September 14–16, 2022.

The business survey is based on a sample of 418 business leaders in the U.S. who have responsibility for making decisions regarding customer payment options, IT/data security, or online sales strategy and planning. Respondent companies must offer credit/debit card or digital payment options to their customers in addition to online/mobile payment.

The anonymous survey was conducted using an online panel with fieldwork conducted

September 13–21, 2022.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: