article written by Ron Shevlin, the Managing Director of Fintech Research at Cornerstone Advisors

A recent article in The Observer, titled 2021, The Year of Fintech Failure asserted: “There’s a strong case to frame 2021 as the year that very dominant companies failed to realize their grandest fintech dreams.”

Perhaps, but not “realizing grandest dreams” hardly makes someone or something a failure. In fact, there’s a strong case to make that 2021 was fintech’s most successful year to date (and, in fact, the article’s author says he was trying to be provocative).

Investment in fintech startups skyrocketed in the past year, the valuations of many fintechs are in the stratosphere, and consumer adoption of a wide range of fintech tools and applications increased significantly in 2021.

That just makes finding the “biggest” winners and the rare losers more difficult. But that’s what we’re here for at the Fintech Snark Tank. This year’s winners: Square, Plaid, Klarna, SoFi, and OpenSea.

Square…uh, I mean Block…had quite a year. Beyond its financial results (which is a tiny part of the criteria to make this list), Square:

Partnered with TikTok to capture the creator economy. The TikTok deal enables merchants on the social media platform to setup online stores and connect users viewing TikTok videos and ads to products available on the merchants’ Square Online store.

Partnered with Google. The partnership enables Square’s merchants to add their products to Google’s surfaces including Search, the Shopping tab, Images, Maps, and YouTube.

Acquired AfterPay. Buy now, pay later (BNPL) might be the top trend of 2021, but this deal is really about is bringing AfterPay’s merchant relationships into Square’s seller ecosystem and converting AfterPay’s existing customer base into Cash App users.

Was one of the fastest growing brands among Millennials and Baby Boomers. No surprise re: the younger generation, but totally unexpected for the older one. OK, boomers!

On top of these accomplishments, Square helped rev up the Web3 renaming trend started by Facebook by changing its name to Block and gaining a full-time CEO (with @Jack’s resignation from Twitter) for the first time in the company’s history.

Not a bad resume for the year.

Square’s strength and momentum on both the consumer (Cash App) and merchant sides of its platform makes the company the biggest threat to incumbent banks and card networks.

It’s not often that a failed deal turns out to be a blessing in disguise, but the DOJ’s nixing of Visa’s planned $5.3 billion acquisition of Plaid was just that for the fintech. It opened the door for a $425 million fund raise in April 2021 that valued Plaid at $13.4 billion. Other 2021 developments that helped put Plaid on this list:

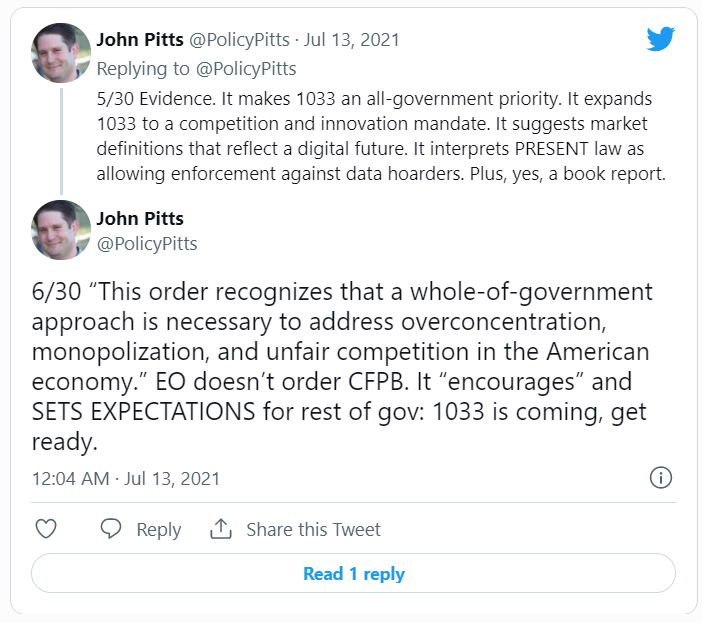

Biden’s open banking executive order. While the EO didn’t actually mandate anything, it “encourages” the CFPB to make open banking and data portability a priority—a huge boon to data aggregators like Plaid. As Plaid’s head of policy, John Pitts, tweeted:

Plaid launched a payments ecosystem. In October, Plaid announced a new payments partner ecosystem—including more than 50 payment and technology companies—that will attempt to make ACH bank transfers a more attractive alternative to credit card transactions.

A new fintech data security framework. The Open Finance Data Security Standard (OFDSS) specifies a host of requirements that address security risks commonly encountered by fintechs that handle financial data.

Plaid may make this year’s list of biggest winners, but the entire data aggregation space—including firms like Finicity, MX, and Akoya—are all winners. For banks and fintechs, the choice of data aggregator has become a strategic vendor choice.

With buy now, pay later-related purchases growing to $100 billion in the US, plenty of BNPL providers could be considered winners in 2021. But Klarna deserves special attention. As I wrote earlier in the year:

“What’s important about BNPL is its place in the customer journey. Traditionally, installment payments, point-of-sale financing, BNPL—whatever you call it—was a checkout option (i.e, the end of the customer journey). Today, BNPL influences consumers’ choices of products and providers (i.e., the beginning of the journey).”

Klarna is doing just that with its ecosystem of investments and acquisitions. As WhiteSight notes:

“Through the vertical and horizontal exploration of its extensive ecosystem, Klarna has been gathering blocks to build a one-of-its-kind shopping super app.”

The success of BNPL belies a bigger and more important trend: Payments have become an important element of the selling proposition. For example, by varying payment terms—for example, spreading payments for a purchase over a period of time—marketers can influence consumers’ likelihood to buy.

Plenty of fintechs saw strong percentage growth in 2021 (from an account perspective). But none of them have their name on a fancy new football stadium that will host the Super Bowl in 2022. But that’s not why SoFi makes the list. It’s on the list because:

It’s growing fast and it’s profitable. The third quarter of 2021 was the fifth consecutive quarter that SoFi delivered a positive EBITDA.

It’s got a bank charter. In March 2021, SoFi announced it would acquire Golden Pacific, reducing the fintech’s reliance on banks, and enabling it to expand its lending efforts and improve margins.

It’s got Galileo. IMHO, this is the crown jewel in the SoFi portfolio. The payments processing platform, acquired by SoFi in 2020, continues to ride the banking-as-a-service boom and is nearing the 100 million account milestone.

At the start of the pandemic in March 2020—roughly two years after OpenSea launched its NFT platform—the company had 4,000 users doing $1.1 million in monthly transactions, generating about $28,000 in monthly revenue.

In 2021, the non-fungible token (NFT) market exploded—as did OpenSea. In July, the company processed $350 million in NFT trades and raised $100 million at a $1.5 billion valuation.

A month later NFT FOMO peaked, as did OpenSea’s trading volume, reaching $3.4 billion—producing $85 million in commissions. Transaction volume has since declined to roughly $2 billion a month, but the platform currently has 1.8 million active users and a large share of the NFT market.

OpenSea’s NFT exchange is just tip of the decentralized finance (DeFi) iceberg that traditional finance is headed towards, and part of what John St. Capital calls the “financialization of everything.”

After promising a Q3 2021 launch of its innovative Plex checking account, Google killed the product at the beginning of October 2021. That doesn’t put Google on the loser list this year, but helped to put their bank partners—who were strung along for nearly two years—on the list.

Google Plex could have been a digital checking account killer app. According to a study from Cornerstone Advisors, the product’s features garnered strong interest among Gen Zers and Millennials, including “Get gas” and “Get food” buttons that would help users find the nearest gas station or restaurant and automatically pay for the purchases.

The Google Plex account could have made a dent in the banking market. Nearly one in five consumers said they would have opened a Google Plex account when it launched. Among Apple Pay and Google Pay users, 33% said they would open an account.

While all 11 of Google’s announced partners lose out because of this, the two digital banks that Google partnered with—BankMobile and Green Dot—stood to gain a disproportionate percentage of applicants with a third of would-be Google Plex applicants indicating that they would choose one of the two digital banks.

In November, Germany-based neobank N26 announced that it would close its US operations, which it launched in 2019. The company claimed to have 500,000 US consumers—a number I couldn’t come close to corroborating with my own consumer research.

Some industry observers have chalked up N26’s US failure to reasons like “global banking is hard,” and “the US is a hostile regulatory environment.” These might be contributing factors, but the seeds of N26’s US failure were sown right from the very start of its launch in July 2019:

Incorrect market assumptions. In an interview back in July 2019, N26’s US told me that N26 believed Americans are disgruntled—the mobile banking experience here is poor., and many consumers experience hidden account and overdraft fees. Whoever’s telling Europeans that Americans hate their banks and that we think the mobile banking experience sucks needs to stop.

No product/segment differentiation. While many banks and credit banks have jumped on the early paycheck bandwagon in 2021, even in 2019, Chime and Varo were offering this feature, making it an undifferentiated feature for N26. No fees is an attractive pricing approach, but again, other challenger banks beat N26 to that punch.

Insufficient marketing. Chime spends roughly $100 million a year in TV and print advertising. With a similar set of products to Chime and Varo, N26 was deceiving itself thinking it could succeed with just word-of-mouth and referral marketing.

There are two firms that deserve dishonorable mention for 2021. Neither is a “loser” for 2021, but current events and trends are setting these companies up to make the Loser list sometime in the near future.

The bank is hardly a loser for 2021. After all, the megabank’s stock price is up 46% year-to-date (as of December 3), and it ranked first in J.D. Power’s 2021 US Retail Banking Advice Satisfaction Study.

Two forces are starting to negatively impact the bank, however, and will continue to have a negative impact over the next few years:

Overdraft fee pressures. The pressure on the industry to overhaul overdraft fees is heating up, and a recent article on The Street named the three megabanks—Bank of America, JPMorgan Chase, and Wells Fargo—as the industry’s top overdraft “fee harvesters.” The three institutions are certainly looking at a hit on this revenue line item over the next few years.

Like BofA, Visa is doing a lot things right. But two things—companies in particular—could put Visa on a future Loser of the Year list:

Plaid. While the DOJ’s denial of Visa’s planned acquisition of Plaid turned out to be a boon for the fintech, the end result could turn out to be a nagging pain for the card network as Plaid’s payment ecosystem (see above) threatens to cut into the network’s payment volume.

Amazon. Get out your popcorn because this battle between the King Kong retailer and the Godzilla payment network is going to be fun to watch. The retailer said it will stop accepting purchases made with Visa credit cards in the UK starting next year, raising speculation that it might do the same in the US.

About the author

Ron Shevlin is the Managing Director of Fintech Research at Cornerstone Advisors, where he publishes commissioned research reports on fintech trends and advises both established and startup financial technology companies. Author of the Fintech Snark Tank on Forbes, Ron is ranked among the top fintech influencers globally, and is a frequent keynote speaker at banking and fintech industry events.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: