20 Belgian banks roll out mobile payments app that supports both NFC and QR codes

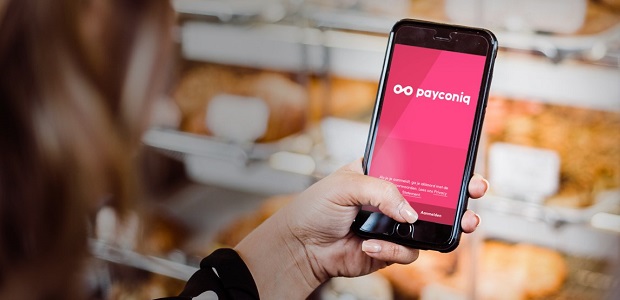

A mobile payments app that supports contactless payment via NFC and both static and dynamic QR codes has been launched in Belgium, according to nfcworld.com . Payconiq by Bancontact enables debit card holders to make payments in store and online and transfer money direct to their contacts using a single app, regardless of the type of smartphone they use.

The app has launched following the merger of peer-to-peer payments service Payconiq and Bancontact, Belgium’s national debit card network operator.

To date, twenty issuing banks have joined the service and payments can be made at 290,000 payment points across the country.

Shoppers with an Android smartphone are able to tap their phone on a contactless terminal to make a payment or use the app’s QR functionality, depending on the options made available by the retailer. iPhone users can also use the service but are only able to use QR at the point of sale.

“We want to be the benchmark for everyday payments in Belgium — in-store, online and between friends,” says Nathalie Vandepeute, Bancontact Payconiq Company’s CEO.

“The new Payconiq by Bancontact payment app takes us into the age of multiform payments and sits perfectly alongside the Bancontact card. Users can choose their method of payment to suit the situation. During the day, they might pay with their Bancontact card at the shopping centre, while in the evening they can buy a drink or snack at a festival using the Payconiq by Bancontact app.”

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: