#1 fintech company on the tik tok platform has agreed to be acquired by tech group Gen Digital in a $1 billion cash deal

Gen Digital Inc. announced that it has entered into a definitive agreement to acquire MoneyLion Inc.

MoneyLion is a leading digital ecosystem for consumer finance. Through this acquisition, MoneyLion extends Gen’s identity solutions into offering comprehensive financial wellness through MoneyLion’s full-featured personal finance platform that includes credit building and financial management services.

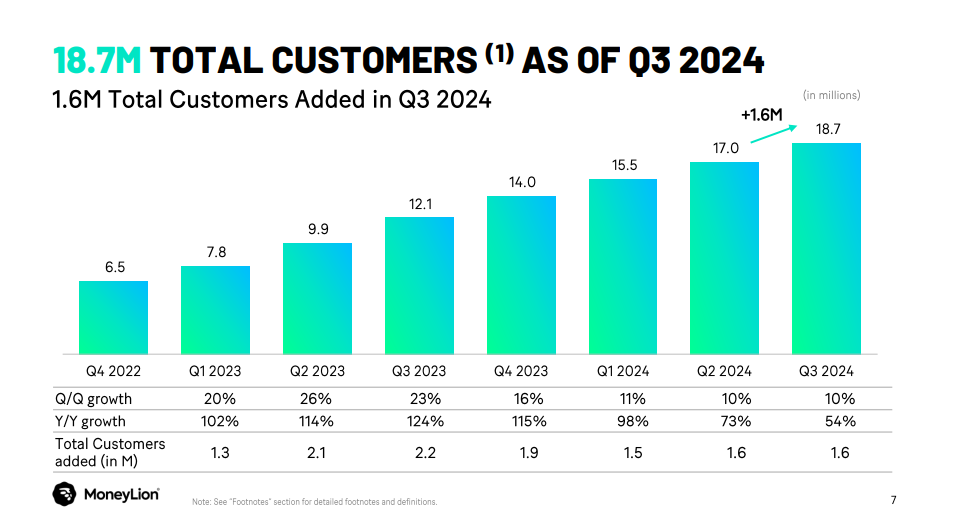

Additionally, Gen acquires a scaled and proven B2B2C white-labeled AI recommendation platform that can be leveraged and enhanced by Gen’s consumer base. MoneyLion’s over 18 million customers broaden and diversify Gen’s customer base, expanding the Company’s top of funnel for full credit and identity protection.

„Gen has a family of consumer brands that’s dedicated to protecting people’s privacy, identity and financial assets so they can live their digital lives securely and without worry,” said Vincent Pilette – CEO of Gen. „By bringing MoneyLion into the Gen family, we’re not only helping people protect what they already have, we’re extending our capabilities to enable people to better manage and grow their financial wealth. We look forward to welcoming the MoneyLion team, so together, we can power digital and financial freedom.„

„MoneyLion has built a mission-driven platform that empowers people to take control of their financial futures with confidence,” said Dee Choubey – Co-Founder and CEO of MoneyLion. „Joining Gen accelerates our vision by leveraging their global reach, trusted brands, and powerful ecosystem. We’ll deliver MoneyLion’s leading personal financial management tools and embedded financial marketplaces to Gen’s users while bringing Gen’s strong identity, trust and cybersecurity solutions to our customers. Together, we’ll create unmatched consumer value, combining innovative fintech products and experiences with Gen’s trusted network to empower smarter financial decisions and secure people’s digital and financial lives.„

Transaction Details and Approvals

The Board of Directors of both Gen and MoneyLion have unanimously approved the proposed acquisition of MoneyLion by Gen for $82.00 per share in cash payable at closing, representing a cash value of approximately $1 billion. In addition, for each share owned, MoneyLion shareholders will receive at closing one contingent value right („CVR”) that entitles the holder to a contingent payment of $23.00 in the form of shares of Gen common stock (issuable based on an assumed share price of $30.48 per Gen share) if Gen’s average volume-weighted average share price reaches at least $37.50 per share over 30 consecutive trading days from December 10, 2024 until 24 months after close.

There can be no assurance that any payments will be made with respect to CVRs. It is expected that the CVRs will be listed on the Nasdaq Stock Market.

Closing of the proposed acquisition is subject to customary closing conditions and is expected to occur in the first half of Gen’s fiscal year 2026, with no impact to Gen’s fiscal year 2025 guidance as provided on October 30, 2024.

__________

More about Money Lion – Q3 2024 earnings presentation

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: