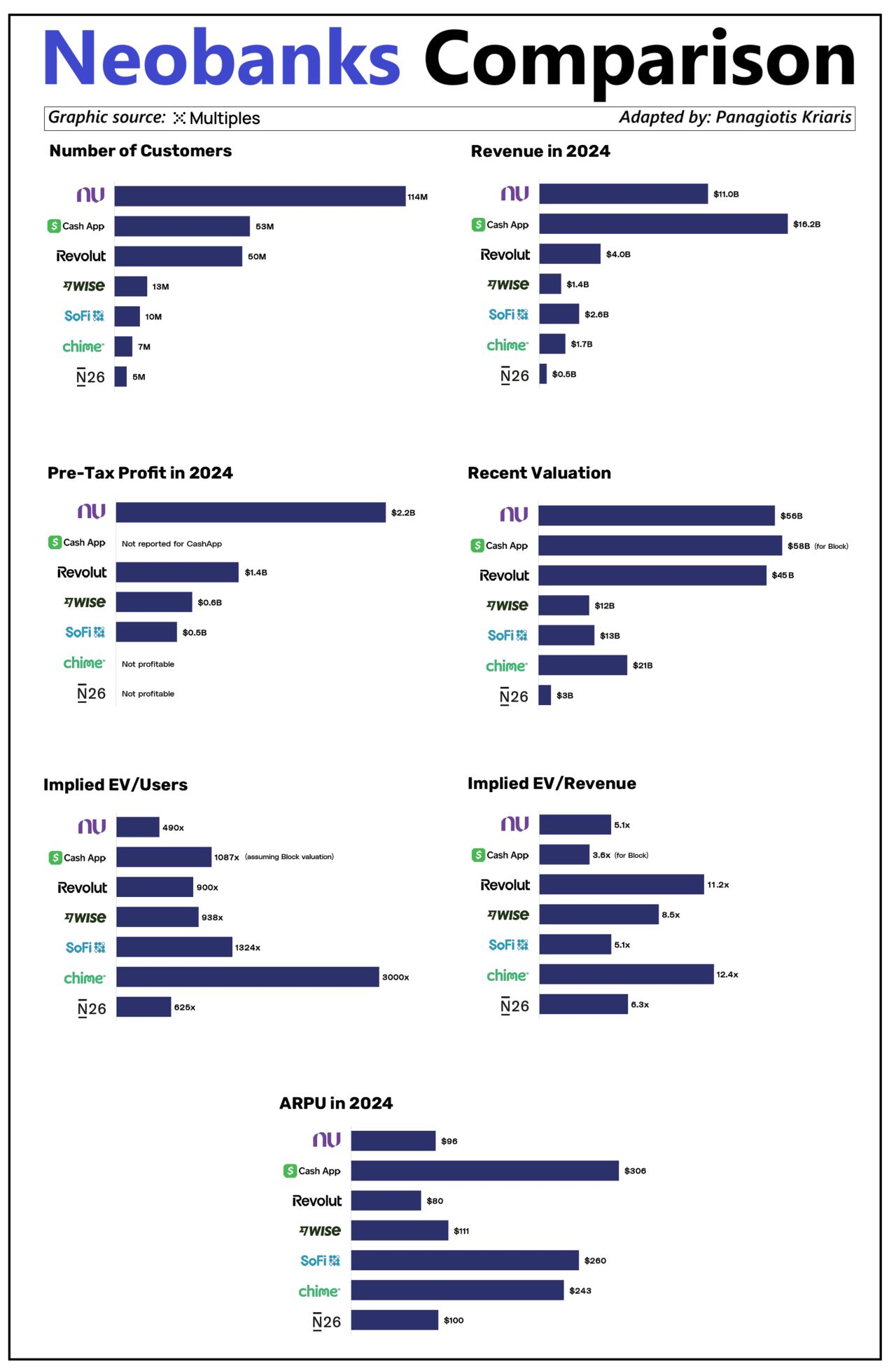

𝗧𝗵𝗲𝘀𝗲 𝗮𝗿𝗲 𝘁𝗵𝗲 𝘁𝗼𝗽 𝗻𝗲𝗼𝗯𝗮𝗻𝗸 𝗽𝗹𝗮𝘆𝗲𝗿𝘀 – 𝘄𝗵𝗼’𝘀 𝗹𝗲𝗮𝗱𝗶𝗻𝗴, 𝗮𝗻𝗱 𝘄𝗵𝘆?

The neobank race is heating up. Based on latest metrics – customers, revenue, profitability, and valuation – each player is taking a distinct path. Let’s see how they compare.

an article written by Panagiotis Kriaris, Director – Head Of Business & Corporate Development at Unzer.

🔹 𝗡𝘂𝗯𝗮𝗻𝗸 leads in customers (114M), revenue ($11B), and pre-tax profit ($2.2B). With a valuation of $65B and efficient monetization ($96 Average Revenue per User – ARPU), it’s the most balanced model at scale.

🔹 𝗖𝗮𝘀𝗵 𝗔𝗽𝗽 posts the highest revenue ($16.2B) and ARPU ($306), reflecting strong monetization through Bitcoin and services. But its metrics blend into Block’s broader business, limiting standalone clarity.

🔹 𝗥𝗲𝘃𝗼𝗹𝘂𝘁 has scaled fast (50M users, $4B revenue), with solid profitability ($1.4B) and a $45B valuation. Its $80 ARPU and 11.2× EV/revenue show strong expectations baked in.

🔹 𝗪𝗶𝘀𝗲 keeps margins healthy ($1.4B revenue, $0.6B profit) on just 13M users, with best-in-class ARPU ($111). At a $12B valuation, it’s viewed as efficient, but niche.

🔹 𝗦𝗼𝗙𝗶 stands out for diversification (banking + investing) and posts $2.6B revenue. Yet despite profitability, its high EV/user (1,324×) may reflect overvaluation.

🔹 𝗖𝗵𝗶𝗺𝗲 shows solid revenue ($1.7B) but remains unprofitable. Its high ARPU ($243) suggests pricing power, but a $21B valuation with no profit raises some questions.

🔹 𝗡𝟮𝟲 lags in scale (5M users) and revenue ($0.6B), with no profit. Despite this, its $3B valuation and $100 ARPU hint at regional strength but limited breakout potential.

𝗞𝗲𝘆 𝘁𝗮𝗸𝗲𝗮𝘄𝗮𝘆: scale alone isn’t enough. The most valuable neobanks combine user growth, strong ARPU, and clear profit paths. As investors have shifted focus from growth at all costs to fundamentals, long-term sustainability will define the next generation of winners.

Dariusz Mazurkiewicz – CEO at BLIK Polish Payment Standard

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: