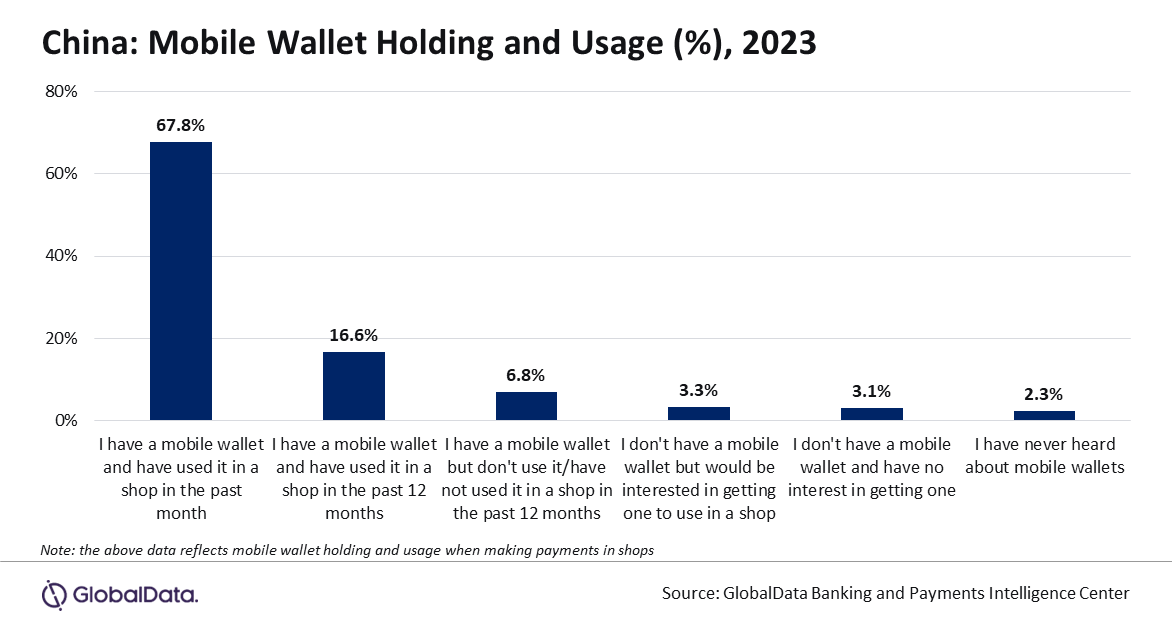

Only 6,4% of the population in China have no mobile wallet while 2,3% never heard about mobile wallets.

Mobile wallets have become the dominant payment method in China, with over 84% of users utilizing them for transactions in the past year. This surge is driven by widespread smartphone and internet accessibility, QR code-based payment adoption, and the popularity of domestic brands like Alipay and WeChat Pay, according to GlobalData, a leading data and analytics company.

GlobalData’s 2023 Financial Services Consumer Survey* reveals that China is among the top countries globally in terms of mobile wallet adoption, with 84.4% survey respondents indicating that they had a mobile wallet and used in a shop in the past 12 months.

Asian markets are spearheading the adoption of mobile wallets, with eight among the top 10 markets with high mobile wallet adoption are from this the region.

Poornima Chinta – Senior Banking and Payments Analyst at GlobalData, comments: “The availability of low-cost smartphones and high-speed internet provided the necessary digital infrastructure for the growth of mobile wallets. This was also supported by the increasing adoption of QR code-based payments among merchants from street vendors to retail chains. The consumer preference for domestic mobile wallet brands including Alipay and WeChat Pay is also significantly contributing to this growth.”

China is home to one of the most mature mobile wallet markets in the world. Mobile wallets are widely used for day-to-day transactions at supermarkets, street stalls, and on public transport, as well as for online payments. Alipay and WeChat Pay are household names and are widely accepted among the merchants.

Alipay and WeChat Pay, with more than one billion users each globally, dominate the mobile payment market in China. WeChat Pay’s widespread adoption can be attributed to its integration into the popular instant messaging and social media platform WeChat. International brands such as Apple Pay and Samsung Pay are also making their presence felt in the market, though their mass adoption is still a distant reality.

Alipay and WeChat Pay also allow overseas travellers to link their international cards such as Visa and Mastercard with wallets and make payments at merchants across China.

The growth in the market is also supported by the government’s push for the adoption and usage of e-CNY – the country’s central bank digital currency. The central bank is working on a unified QR code for its digital currency e-CNY, which is expected to further drive interoperability and growth of mobile wallets. This technology will allow the usage of e-CNY payments through a single QR code across various digital payment apps such as Alipay and WeChat Pay, streamlining the payment process for both consumers and merchants.

Chinta concludes: “The Chinese mobile wallet market is poised for further expansion over the next few years. This will be driven by the government initiatives, a sizable tech-savvy population, the rising acceptance of QR code-based payments among merchants, and a growing preference for cashless payment methods.”

______________

*GlobalData’s 2023 Financial Services Consumer Survey was carried out in Q2 2023. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Banking 4.0 – „how was the experience for you”

„To be honest I think that Sinaia, your conference, is much better then Davos.”

Many more interesting quotes in the video below: